A Guide To Understanding Its Implications

Uncover the Meaning of Pty Ltd: A Guide to Understanding Its Significance

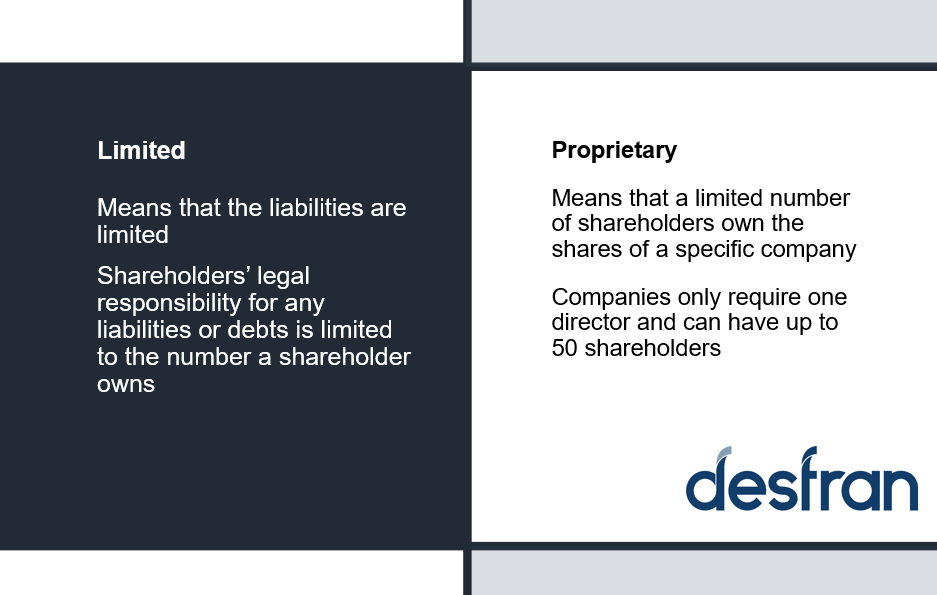

Pty Ltd (Proprietary Limited) is a common designation for private companies in Australia. It signifies that the company is limited by shares and has a separate legal identity from its owners.

Pty Ltd companies offer several benefits, including limited liability, tax efficiency, and flexibility in management. Historically, the Pty Ltd designation emerged in the 19th century to distinguish private companies from public companies.

Meaning of Pty Ltd

Comprehending the essential aspects of the meaning of Pty Ltd is crucial for understanding the significance and implications of this business structure.

- Entity Type: Private company

- Legal Identity: Separate from owners

- Liability: Limited by shares

- Taxation: May offer tax advantages

- Management: Flexible and customizable

- Ownership: Restricted to shareholders

- Purpose: Business operations

- Compliance: Subject to specific regulations

- Registration: Required with relevant authorities

These aspects collectively define the Pty Ltd structure, influencing its use, advantages, and legal implications. Understanding these aspects enables businesses to make informed decisions about adopting the Pty Ltd structure and leveraging its benefits effectively.

Entity Type

The Entity Type aspect of Pty Ltd refers to its classification as a private company, distinct from public companies and other business structures.

- Ownership Structure: Pty Ltd companies have a limited number of shareholders, typically consisting of the company's founders, family members, or a small group of investors.

- Share Transfer: Shares in a Pty Ltd company are not publicly traded and can only be transferred with the consent of the existing shareholders, providing greater control over ownership.

- Liability: Shareholders in a Pty Ltd company have limited liability, meaning their personal assets are generally protected from business debts and liabilities. This liability protection is a key advantage of the Pty Ltd structure.

- Governance: Pty Ltd companies have flexible governance structures, allowing for tailored decision-making processes and management styles to suit the specific needs of the business.

Overall, the Entity Type aspect of Pty Ltd signifies a private company structure with restricted share ownership, limited liability, and customizable governance, making it a suitable choice for businesses seeking privacy, control, and liability protection.

Legal Identity

Within the meaning of Pty Ltd, the Legal Identity: Separate from owners aspect holds significant importance, distinguishing Pty Ltd companies from other business structures and providing several advantages.

- Distinct Legal Entity: Pty Ltd companies are recognized as separate legal entities from their owners, meaning the company has its own rights, obligations, and liabilities.

- Protection of Personal Assets: This legal separation protects the personal assets of the owners from business debts and liabilities. Shareholders are only liable to the extent of their investment in the company.

- Business Continuity: The separate legal identity ensures business continuity even if the ownership of the company changes. The company's existence and operations are not affected by changes in shareholders.

- Tax Implications: The legal separation allows Pty Ltd companies to have their own tax status, separate from the owners' personal tax status. This can provide tax advantages and flexibility in tax planning.

In summary, the Legal Identity: Separate from owners aspect of Pty Ltd is key to understanding the structure and advantages of this business type. It provides liability protection, business continuity, and tax benefits, making it a suitable choice for businesses seeking to limit personal risk and optimize their operations.

Liability

The Liability: Limited by shares aspect is a critical component of the meaning of Pty Ltd, shaping its legal and financial implications. This concept refers to the limited liability of shareholders in a Pty Ltd company, meaning their personal assets are protected from business debts and liabilities.

This limited liability is attributed to the separate legal identity of Pty Ltd companies. Shareholders are only liable to the extent of their investment in the company, providing a significant advantage in managing financial risks. In contrast, in other business structures like sole proprietorships or partnerships, owners have unlimited liability, exposing their personal assets to business obligations.

Real-life examples of Liability: Limited by shares within Pty Ltd are prevalent. Consider a scenario where a Pty Ltd company incurs significant debts. In such a situation, creditors can only make claims against the company's assets, and shareholders are not personally liable for these debts. This protection encourages entrepreneurs and investors to engage in business ventures without risking their personal wealth.

Understanding the practical applications of Liability: Limited by shares is crucial for business owners and investors. It allows them to make informed decisions about the appropriate business structure for their needs and risk tolerance. For individuals seeking to minimize personal financial risk while pursuing business opportunities, the Pty Ltd structure offers a valuable framework.

In summary, the Liability: Limited by shares aspect of Pty Ltd is a cornerstone of its legal and financial framework, providing significant advantages in risk management and encouraging entrepreneurial endeavors.

Taxation

Within the meaning of Pty Ltd, the aspect of Taxation: May offer tax advantages holds significant relevance. Pty Ltd companies have the potential to provide certain tax benefits and flexibilities compared to other business structures.

- Business Structure Flexibility: Pty Ltd companies allow for various business structures, including companies with different classes of shares, which can be tailored to optimize tax outcomes.

- Dividend vs. Salary Optimization: Pty Ltd companies provide flexibility in distributing profits, enabling business owners to optimize their tax positions by choosing a balance between dividends and salaries.

- Tax Deferral: In certain circumstances, Pty Ltd companies may allow for the deferral of tax on undistributed profits, providing cash flow advantages.

- Access to Small Business Concessions: Pty Ltd companies may qualify for various small business concessions and tax exemptions, depending on their size and revenue.

These tax advantages and flexibilities make Pty Ltd companies an attractive option for entrepreneurs and small business owners seeking to minimize their tax burden and maximize their financial returns.

Management

Within the meaning of Pty Ltd, the aspect of Management: Flexible and customizable holds significant importance, empowering business owners with the ability to tailor their management structures and decision-making processes to suit their unique needs and objectives.

This flexibility stems from the separate legal identity of Pty Ltd companies. Unlike partnerships or sole proprietorships, where management structures are often rigid, Pty Ltd companies provide the freedom to establish customized management roles, responsibilities, and reporting lines that align with the company's specific goals and industry requirements.

Real-life examples of Management: Flexible and customizable within Pty Ltd are evident in various industries. Startups and small businesses often adopt agile management styles, fostering collaboration and quick decision-making. In contrast, larger Pty Ltd companies may implement more structured management hierarchies with clear lines of authority. The flexibility to adapt management structures allows Pty Ltd companies to respond effectively to changing market conditions and business needs.

The practical applications of understanding Management: Flexible and customizable in the meaning of Pty Ltd are multifaceted. Business owners can leverage this flexibility to:

- Optimize decision-making processes

- Attract and retain talented individuals

- Adapt to evolving industry trends

- Maintain a competitive advantage

In summary, the Management: Flexible and customizable aspect of Pty Ltd empowers business owners with the ability to tailor their management structures to meet their specific needs, fostering innovation, efficiency, and long-term success.

Ownership

Within the meaning of Pty Ltd, the aspect of Ownership: Restricted to shareholders holds significant implications for the company's structure, decision-making, and financial management.

- Number of Shareholders: Pty Ltd companies typically have a limited number of shareholders, often comprising the founders, family members, or a small group of investors.

- Transfer of Shares: Shares in a Pty Ltd company are not publicly traded and can only be transferred with the consent of the existing shareholders, providing greater control over ownership.

- Shareholder Agreements: Pty Ltd companies often have shareholder agreements in place, outlining the rights, responsibilities, and dispute resolution mechanisms among shareholders.

- Impact on Decision-Making: The restricted ownership structure in Pty Ltd companies can influence decision-making processes, as key decisions are typically made by the shareholders or a board of directors appointed by the shareholders.

Overall, the Ownership: Restricted to shareholders aspect of Pty Ltd companies shapes the company's ownership dynamics, control mechanisms, and decision-making processes, distinguishing it from other business structures with more dispersed ownership.

Purpose

The aspect of Purpose: Business operations holds fundamental significance within the meaning of Pty Ltd, shaping its core objectives and activities.

Pty Ltd companies are established primarily for the purpose of conducting business operations, engaging in commercial activities to generate revenue and achieve specific business goals. This purpose distinguishes Pty Ltd companies from other types of legal entities, such as non-profit organizations or trusts, which have different primary objectives.

Real-life examples of Purpose: Business operations within Pty Ltd are prevalent in various industries. Numerous Pty Ltd companies operate in sectors such as retail, manufacturing, technology, healthcare, and professional services. These companies engage in diverse business activities, from selling goods and providing services to developing products and offering consulting expertise.

Understanding the Purpose: Business operations aspect of Pty Ltd is crucial for several reasons. First, it clarifies the primary objective of Pty Ltd companies, which is to engage in commercial activities and generate revenue. Secondly, it assists in distinguishing Pty Ltd companies from other types of legal entities with different purposes.

In summary, the Purpose: Business operations aspect is a defining characteristic of Pty Ltd, emphasizing the company's primary objective of engaging in commercial activities and generating revenue. This understanding helps in classifying Pty Ltd companies and recognizing their role in the business landscape.

Compliance

Within the meaning of Pty Ltd, the aspect of Compliance: Subject to specific regulations holds significant relevance, shaping the company's obligations and responsibilities within the legal and regulatory landscape.

Pty Ltd companies are required to adhere to various regulations and laws governing their formation, operation, and dissolution. These regulations aim to ensure transparency, accountability, and fair business practices. Compliance with these regulations is crucial for maintaining the integrity of the company and avoiding legal penalties or reputational damage.

Real-life examples of Compliance: Subject to specific regulations within Pty Ltd include adhering to taxation laws, maintaining accurate financial records, complying with industry-specific regulations, and meeting environmental standards. Failure to comply with these regulations can result in fines, audits, or even legal action.

Understanding the practical applications of Compliance: Subject to specific regulations is essential for Pty Ltd companies to operate within the legal framework, maintain good standing with regulatory bodies, and protect their reputation. It also fosters a culture of ethical and responsible business conduct, contributing to the overall stability and integrity of the business environment.

Registration

Within the meaning of Pty Ltd, the aspect of Registration: Required with relevant authorities holds critical importance, shaping the company's legal existence and compliance obligations.

- Entity Formation: Pty Ltd companies must be formally registered with the Australian Securities and Investments Commission (ASIC) to gain recognition as a separate legal entity.

- Business Name Registration: The company's proposed business name must be registered with ASIC to ensure its uniqueness and compliance with naming regulations.

- Tax File Number (TFN): Pty Ltd companies are required to obtain a TFN from the Australian Taxation Office (ATO) for tax purposes, enabling them to lodge tax returns and fulfill their tax obligations.

- Australian Business Number (ABN): The ABN is a unique identifier issued by the ATO, which Pty Ltd companies must obtain to engage in business activities, including invoicing and claiming GST credits.

These registration requirements are fundamental to the establishment and operation of Pty Ltd companies. They provide legal recognition, facilitate compliance with taxation and regulatory obligations, and contribute to the overall transparency and integrity of the business landscape.

In conclusion, our exploration of the meaning of Pty Ltd has illuminated several key ideas. Firstly, Pty Ltd companies are distinct legal entities, separate from their owners, offering limited liability protection. This feature encourages entrepreneurship and investment by mitigating personal financial risk. Secondly, Pty Ltd companies provide flexibility in management and ownership structures, enabling businesses to tailor their operations to suit their unique needs and goals. Thirdly, Pty Ltd companies are subject to specific regulations and compliance obligations, ensuring transparency, accountability, and adherence to legal frameworks.

These interconnected concepts shape the essence of Pty Ltd companies, making them a popular choice for businesses seeking a balance of liability protection, management flexibility, and legal compliance. Understanding the meaning of Pty Ltd empowers individuals and organizations to make informed decisions about business structures, risk management, and legal obligations. As the business landscape continues to evolve, Pty Ltd companies are likely to remain a cornerstone of the Australian business ecosystem, fostering innovation, growth, and economic prosperity.

ncG1vNJzZmifn6q%2FrrHTZpyxZqObvHN6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmamnZGjtq%2BzjKidZqikrnqtwMNnn62lnA%3D%3D